BTC Price Prediction: Technical Breakout Potential Amid Institutional Momentum

#BTC

- Technical Momentum: Price above 20-day MA with MACD indicating bullish short-term momentum

- Institutional Adoption: Major treasury strategies and regulatory developments supporting long-term growth

- Macro Environment: Federal Reserve policy expectations creating favorable conditions for risk assets

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Averages

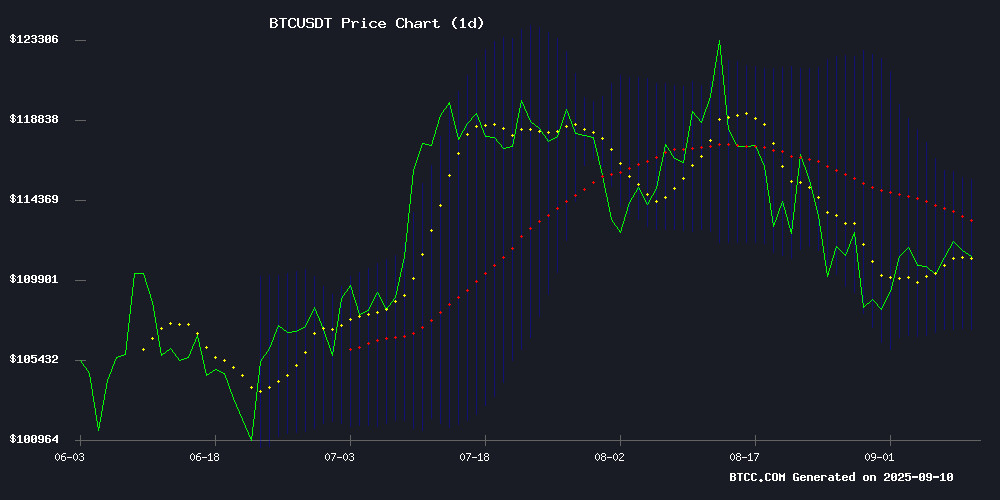

BTC is currently trading at $113,293, firmly above its 20-day moving average of $111,441, indicating sustained bullish momentum. The MACD reading of 1,467 suggests positive short-term momentum, though the negative histogram value of -1,158 warrants monitoring for potential trend shifts. Price action NEAR the upper Bollinger Band at $115,721 suggests potential resistance testing ahead.

According to BTCC financial analyst James: 'The technical setup remains constructive with price holding above key support levels. A sustained break above $115,721 could open the path toward testing all-time highs.'

Market Sentiment: Institutional Developments Drive Positive BTC Outlook

Recent developments including Asset Entities' $1.5 billion BTC treasury strategy and Metaplanet's $1.4 billion Bitcoin acquisition signal strong institutional confidence. The US Treasury's move to formalize Bitcoin custody rules provides regulatory clarity, while Federal Reserve rate cut expectations create favorable macro conditions.

BTCC financial analyst James notes: 'The combination of institutional adoption and regulatory progress creates a fundamentally supportive environment. While short-term volatility may persist, the structural bullish case remains intact.'

Factors Influencing BTC's Price

Robinhood Stock Surges on S&P 500 Inclusion, Eyes 27% Rally to $150

Robinhood's stock ($HOOD) has surged 17% in the past five days, trading near $118.50, with analysts eyeing a 27% rally to $150. The momentum follows its inclusion in the S&P 500 index, set for September 22, which has forced index funds and ETFs to add the stock to their portfolios.

Beyond the S&P 500 boost, Robinhood's expansion into credit cards, mortgages, and global tokenized assets could drive long-term growth. The platform's embrace of crypto trading, including Bitcoin (BTC), positions it favorably as institutional interest in digital assets grows.

MicroStrategy, a notable BTC-treasury firm, was passed over for S&P 500 inclusion despite eligibility, highlighting Robinhood's stronger market positioning. The stock's next phase hinges on sustaining momentum through product innovation and broader crypto adoption.

DC Sues Athena Bitcoin Over Hidden Fees and Scam-Linked Deposits

Washington, DC Attorney General Brian Schwalb has taken legal action against Athena Bitcoin, a crypto ATM operator, accusing it of imposing concealed fees and neglecting anti-fraud protocols. The lawsuit reveals that 93% of deposits processed by Athena's machines in its initial five months were tied to fraudulent activities. Schwalb condemned the company's no-refund policy, which effectively blocks victims from recovering lost funds and undisclosed charges.

Athena allegedly levied transaction fees as high as 26% without transparent disclosure, masking them under the term "Transaction Service Margin" in its Terms of Service. The attorney general's office asserts these practices target vulnerable groups, including the elderly, with one victim reportedly losing $98,000. "Athena knows its machines are primarily used by scammers but chooses to ignore it to profit from hidden fees," Schwalb stated.

LBank Labs' Czhang Lin Highlights Decentralized AI's Role in Reshaping Global Computing at TBOS Webinar

Czhang Lin, Head of LBank Labs and Partner at LBank, delivered a keynote at the TBOS 2025 online webinar, outlining how decentralized AI could revolutionize global computing power allocation. His talk emphasized the shift from centralized resource control to equitable, transparent systems enabling universal access.

The integration of AI with decentralized frameworks addresses critical imbalances in computing power distribution. By democratizing access, these systems empower developers and communities worldwide, fostering innovation beyond traditional financial applications.

LBank Labs continues to expand its ecosystem through initiatives like sponsoring Bitcoin 2025 and the upcoming 1001 Nights Festival in Korea. These efforts position Web3 as a cultural and technological bridge, transcending its role as mere financial infrastructure.

Bitcoin Stabilizes Near $114K as Market Watches Key Resistance Levels

Bitcoin's price action shows signs of consolidation near the $114,000 mark after recent volatility. The cryptocurrency faces a critical test at the 100-day moving average resistance, with on-chain data suggesting continued accumulation by investors.

Technical indicators paint a mixed picture. The daily chart's ascending channel breakout lacks follow-through, while the 4-hour timeframe shows compression near resistance. A decisive close above $114,000 could target the $124,000 all-time high zone, but rejection may see bears test support at $104,000.

Market participants appear to be positioning for the next major move as the RSI hovers at neutral 50. The 200-day moving average near $101,000 looms as final support should bearish momentum accelerate.

Asset Entities Approves Merger With Vivek Ramaswamy's Strive, Paving Way for $1.5B BTC Treasury Strategy

Asset Entities Inc (ASST) shareholders have greenlit a merger with Strive Enterprises, setting the stage for the combined entity—rebranded as Strive Inc.—to pursue an ambitious Bitcoin treasury strategy. The deal, following Strive's shareholder approval on September 4, positions the company to potentially deploy over $1.5 billion in capital.

Former presidential candidate Vivek Ramaswamy, who co-founded Strive in 2022, sees the merger as a watershed moment for institutional crypto adoption. Matt Cole, current head of Strive Asset Management, will helm the new entity as chairman and CEO, while Asset Entities' Arshia Sarkhani transitions to chief marketing officer.

The merger's completion hinges on Nasdaq listing clearance and customary closing conditions. Upon finalization, Strive expects to secure $750 million in private placement financing, with total potential proceeds exceeding $1.5 billion if warrants are exercised. Cole emphasized the company's debt-free structure and disciplined approach to maximizing bitcoin-per-share growth.

Market reaction was immediate, with ASST shares surging 38% in mid-morning trading. The move signals growing corporate confidence in Bitcoin as a treasury asset, following MicroStrategy's pioneering strategy.

US Treasury Moves to Formalize Bitcoin Custody Rules in New Spending Bill

The United States is taking concrete steps toward establishing formal custody protocols for government-held Bitcoin. Congress has advanced H.R. 5166, a fiscal year 2026 appropriations bill that mandates the Treasury Department to publish comprehensive guidelines for securing federal digital asset reserves.

The legislation specifically targets the Strategic Bitcoin Reserve and Digital Asset Stockpile programs initiated by the White House earlier this year. Section 138 requires the Treasury to deliver a public custody plan within 90 days of enactment, detailing security architecture, legal frameworks, and interagency coordination for Bitcoin holdings.

Section 137 goes further, demanding a feasibility study on maintaining digital asset reserves. This includes analyzing balance sheet treatment, private contractor involvement, and the impact of seized Bitcoin on Treasury operations. The move reflects growing institutional recognition of Bitcoin's role in national financial strategy.

Bitcoin Eyes Breakout Toward ATH as Fed Rate Cut Odds Climb

Markets are pricing in nearly 30 basis points of easing for the September Federal Open Market Committee decision, with a 17% probability of a 50bps cut. A more aggressive rate reduction could propel Bitcoin toward all-time highs.

CME Group's FedWatch tool shows a 90% likelihood of a 25bps cut, while Polymarket's prediction contract suggests an 81% chance for 25bps and 17% for 50bps. The economic backdrop has shifted significantly, with the Bureau of Labor Statistics reporting the largest downward jobs adjustment since 2009.

Inflation metrics remain mixed, with Core CPI at 3.1% year-over-year and core PCE at 2.9%. The Treasury curve reflects this uncertainty, with short-term rates anticipating easing while long-term yields stay anchored by structural factors.

Bitcoin Rebounds as Metaplanet Raises $1.4 Billion for BTC Treasury

Bitcoin's price stability near $112,000 reflects growing institutional confidence, underscored by Metaplanet's latest $1.4 billion treasury allocation. The Tokyo-listed firm now mirrors MicroStrategy's aggressive BTC accumulation strategy, reinforcing Bitcoin's role as a corporate reserve asset.

Technical indicators paint a cautiously optimistic picture. The MACD's bullish crossover and RSI's equilibrium suggest balanced momentum, while ascending triangle and Ichimoku Cloud patterns hint at impending volatility. Market capitalization holds firm at $2.24 trillion despite minor 24-hour slippage.

Analysts highlight the ¥205 billion ($1.4B) purchase as a watershed moment for Japanese institutional adoption. 'Metaplanet isn't just dipping toes—they're diving deep,' observed Crypto Patel, noting the transaction's significance for Asian market sentiment.

Metaplanet Stock Plummets 30% Amid Bitcoin Strategy Concerns

Metaplanet's shares have tumbled 28% over the past month as investors question the sustainability of its Bitcoin-centric strategy. The Tokyo-listed firm recently announced plans to issue 385 million new shares at a 9.9% discount, aiming to raise $1.4 billion primarily for Bitcoin acquisitions and options trading expansion.

The company's ambitious goal of accumulating 210,000 BTC by 2027 comes at a precarious time. With Bitcoin trading around $111,041, Metaplanet's current holdings of 20,136 BTC—worth approximately $2.25 billion—now represent the sixth-largest corporate treasury position globally. This aggressive accumulation strategy mirrors the playbook of early Bitcoin adopters like MicroStrategy, but market reaction suggests growing skepticism about dilution risks.

Shareholder approval for capital raises up to 555 billion yen underscores the scale of Metaplanet's crypto ambitions. Yet the stock's decline to ¥614 ($4.18) reflects broader pressures on Bitcoin-heavy firms, particularly those leveraging equity markets to fund digital asset purchases. The coming months will test whether Metaplanet's bet on Bitcoin as a core treasury asset can withstand both crypto market volatility and shareholder scrutiny.

S&P 500 Snubs MicroStrategy for Robinhood Despite Crypto Market Optimism

The S&P 500's recent inclusion of Robinhood over MicroStrategy has sparked debate among crypto market observers. While Coinbase and Block previously earned spots as the first crypto-native companies in the benchmark index, Michael Saylor's MicroStrategy faced unexpected rejection despite meeting key criteria.

Robinhood's selection comes as its market capitalization doubled this year, surpassing MicroStrategy's valuation. The trading platform's broader consumer base and diversified revenue streams likely appealed to S&P's selection committee more than MicroStrategy's singular Bitcoin-focused strategy.

MicroStrategy's exclusion represents a missed opportunity for $10 billion in potential passive investment inflows - funds that could have supported its Bitcoin acquisition strategy and balance sheet requirements. The decision underscores how traditional market indices still evaluate crypto-focused firms through conventional financial metrics rather than blockchain-specific growth potential.

Bitcoin’s Tech Stock Correlation Risks ‘Deeper Drawdowns’

Bitcoin's recent underperformance mirrors the Nasdaq 100's mean reversion phase, leaving the cryptocurrency vulnerable to further declines. Analysts at Ecoinometrics highlight that Bitcoin typically lags during such periods, with heightened risk of deeper drawdowns.

Market attention now turns to the Federal Reserve's potential rate cut on September 17, which could alleviate macroeconomic uncertainty and reignite momentum for risk assets. Institutional investors appear to be positioning for this scenario, with capital flowing into Bitcoin ETFs ahead of a potential rally.

The interplay between crypto and traditional markets grows increasingly evident as macroeconomic factors continue to influence both equities and digital assets. Bitcoin's price action remains tethered to broader market trends, particularly in the technology sector.

How High Will BTC Price Go?

Based on current technical indicators and market developments, BTC shows potential for upward movement toward testing the $120,000-$125,000 range. Key resistance levels to watch include:

| Resistance Level | Price Target | Significance |

|---|---|---|

| Immediate Resistance | $115,721 | Upper Bollinger Band |

| Next Target | $120,000 | Psychological Level |

| Potential Breakout | $125,000+ | All-Time High Test |

BTCC financial analyst James emphasizes: 'The convergence of technical strength and positive fundamental developments suggests potential for new highs, though market participants should monitor the $107,160 support level for any trend changes.'